分析

Week Ahead Playbook: Markets Hit Turbulence As CPI And Earnings Loom

The Week That Was – Themes

Of all the events of the last week – of which there are too many to mention them all in this note – it was perhaps the marked shift in tone from a slew of FOMC speakers that was most significant. After Chair Powell, and Governor Waller, both noted that they were in ‘no rush’ to cut rates a week prior, this commentary was echoed by a plethora of other policymakers this week, including Logan, Kashkari, Barkin, Daly, Bowman and, most importantly, Powell himself.

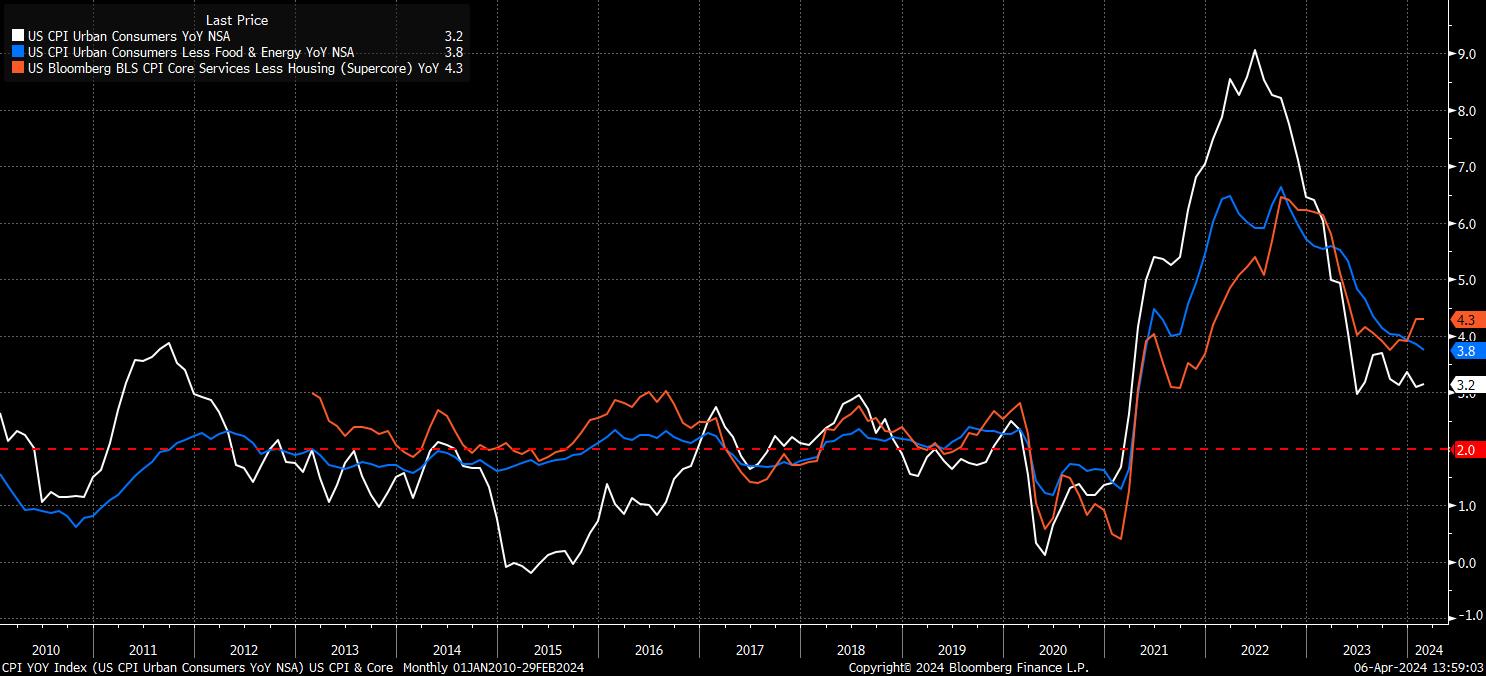

Clearly, ‘no rush to cut’ appears to have become the FOMC’s new mantra, with stubbornly high inflation, coupled with a resilient labour market, and a strong pace of economic growth all pointing to there being little immediate need for policy to become less restrictive. Markets have, unsurprisingly, repriced sharply in a hawkish direction amid this shift in rhetoric, with the USD OIS curve now pricing just 64bp of easing by year-end, substantially less than the 75bp implied by the median dot plot projection in the March SEP, and a marked revision from the >160bp that was priced early in January.

Nevertheless, while Fedspeak has become more hawkish, this does not mean that the ‘Fed put’ is dead and buried. The Committee are still likely to deliver rate cuts this year, while balance sheet run-off is also likely to come to an end. Furthermore, with inflation now returning – albeit in a bumpy manner – towards the 2% target, policymakers still have the flexibility to step in with support, either rate cuts, or liquidity injections, as they see fit, were economic conditions to worsen substantially, or a financial accident to take place. Hence, the path of least resistance over the medium-term should continue to lead higher for risk.

In any case, there are few signs of economic conditions worsening substantially at the current juncture. While the latest ISM services PMI did slip to its lowest level of the year, albeit remaining above 50.0, the comparable manufacturing index rose north of that breakeven mark for the first time since September 2022, implying that the industrial slowdown has bottomed out.

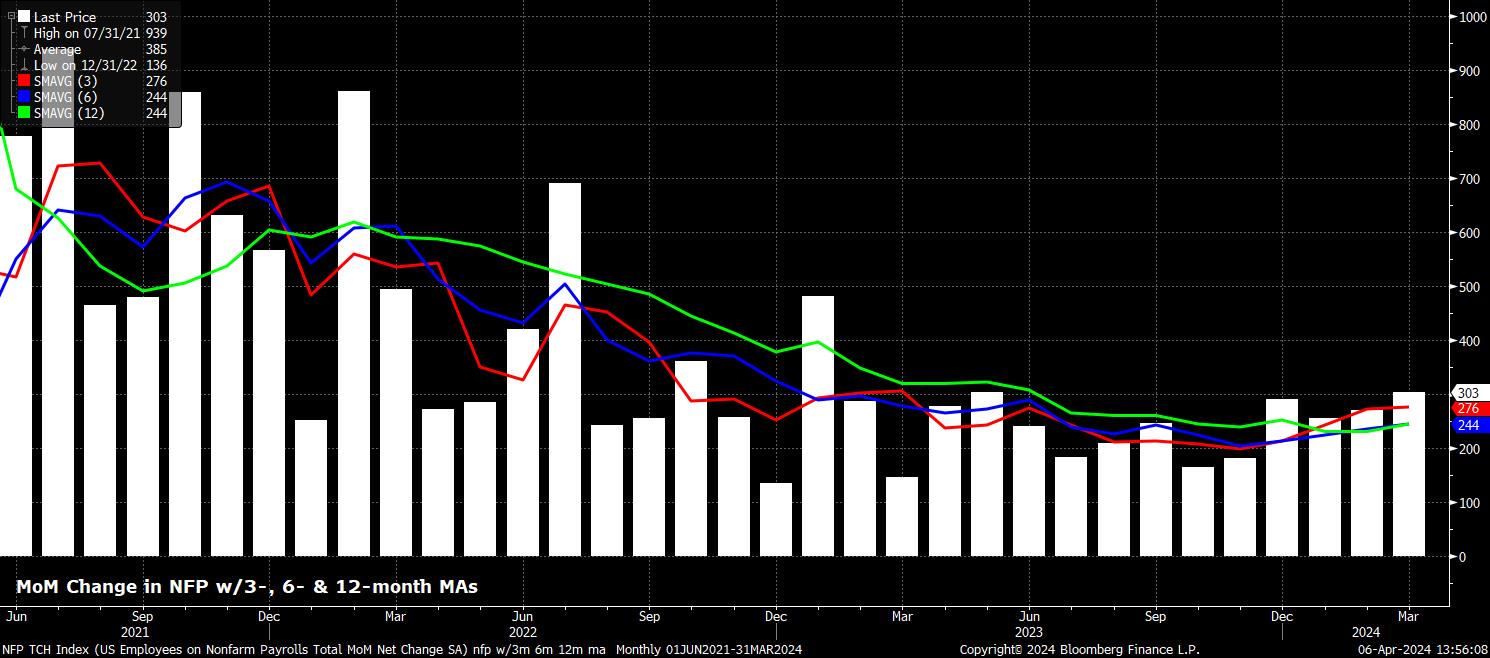

Of more importance than either metric, however, was Friday’s jobs report, which pointed to the blockbuster pace of job growth continuing, and the labour market remaining tight. Headline nonfarm payrolls rose by a blowout +303k in March, the fastest pace in 10 months, while a net +22k revision to the prior two months of data saw the 3-month average of job gains tick higher to +276k, a 12-month high.

Naturally, data like this begs the question of whether rate cuts are needed at all, though one must recall that Chair Powell has flagged that, on its own, strong hiring wouldn’t be a reason to delay the start of policy normalisation.

Other aspects of the labour market report were similarly promising, with unemployment ticking 0.1pp lower to 3.8%, despite an 0.2pp rise in labour force participation, to 62.7%. Average hourly earnings, meanwhile, rose 0.3% MoM, bang in line with consensus, though the annual pace of earnings growth did slip 0.2pp to 4.1% YoY, primarily due to higher comps from 2023 impacting the data.

The Week That Was – Markets

Markets, however, displayed little by way of a prolonged reaction to the payrolls print; seemingly, gone are the days when the monthly US jobs report would deliver significant, and prolonged market moves.

Similarly short-lived was the bout of risk aversion that hit markets late on Thursday, a move that appeared to come as geopolitical tensions struck markets once more, after reports of Israel striking an Iranian consulate in Syria. Market participants reached for the classic risk-off playbook as headlines crossed, with stocks slumping, bonds rallying, along with other havens such as gold. Not only was this, anecdotally speaking, the first time that such a playbook had been seen for a while, Thursday also marked the S&P 500’s first red day, with a >2% intraday range, in over 12 months.

Despite that, the dip in equities was bought relatively rapidly, and in aggressive fashion post-payrolls on Friday, implying that the bulls remain in control, with the aforementioned supportive policy backdrop meaning that the path of least resistance continues to lead to the upside, with said backdrop, to a degree, able to cushion markets from ongoing geopolitical ructions. Friday’s rally, though, wasn’t enough to stop the S&P notching its worst week since January, falling just over 1%.

In truth, though, it was moves away from the equity space that were of more interest last week.

In fact, it was the commodity arena where last week’s most significant market action took place, with gold rallying to fresh record highs, north of $2,300/oz, as the yellow metal continues to shine, despite classic drivers such as real yields, and the dollar, actually posing a headwind. It would, therefore, appear that gold has simply become a momentum trade at this stage, with the clearance of each psychological big figure level bringing fresh buyers to the table.

_D_2024-04-06_13-57-18.jpg)

Crude also enjoyed a strong week, with both WTI and Brent gaining around 4.5% over the last five trading days, rallying north of $85bbl and $90bbl respectively, with both ending Friday at the highest level since last October.

Numerous factors appear to be helping crude, not only the market’s increased focus on the geopolitical landscape in the Middle East. In addition to this, continued OPEC+ output cuts mean that supply remains relatively tight, while Pemex halting some Mexican crude exports over coming months will further tighten the market. On the demand side, meanwhile, the outlook appears to be brightening, as the global manufacturing sector shows signs of improvement, not only given the aforementioned ISM manufacturing data, but also after China’s manufacturing PMI (pinch of salt required!) rose to a one-year high in March.

Of course, if sustained, the crude rally will cause a resurgence in concerns around the stickiness of inflation, particularly with services prices remaining elevated, and the move in crude putting ongoing goods disinflation under threat.

Consequently, it was perhaps no surprise that Treasuries endured a torrid week, with new year-to-date yield highs being seen across the curve, with hawkish Fed rhetoric also helping the bond bears, and seeing the benchmark 10-year yield end the week at its highest level since November. Inflation breakevens have also risen rather sharply, a move that should be kept on the radar ahead of CPI this week.

Compared to all of that, conditions in the FX market were once again relatively subdued. This is, perhaps, best epitomised by the JPY, which remains pinned just shy of the 152 handle, as markets remain jittery about the prospect of MoF intervention were the currency to weaken further.

Though vol remains subdued, the dollar, per the DXY, did briefly rise to fresh YTD highs during the week, as the DXY briefly reclaimed the 105 figure, though this move did appear to be used as an excuse for profits to be taken, and gains thus fizzled out. There is, however, still nothing in the G10 FX world that appears to beat the buck on either a growth or a yield basis, hence further USD gains appear likely, as the ‘US exceptionalism’ narrative rolls on.

The Week Ahead

Turning to the week ahead, another jam-packed slate awaits financial markets, with plenty of risk events for participants to navigate.

The standout event is, of course, the March US CPI report, due Wednesday. Headline CPI is expected to have risen 3.4% YoY last month, an 0.2pp uptick from the February figure, though the figure has surprised to the upside compared to consensus for three straight months. Core CPI, however, should show that underlying disinflation is continuing, with the figure set to dip to 3.7% YoY, from 3.8% prior.

In addition to these prints, both the ‘supercore’ inflation metric, and the annualised MoM prints will be closely interrogated for signs of inflation stubbornness. Although both sides of the dual mandate are coming back into better balance, it is still inflation figures that are the primary driver of the FOMC’s thinking, particularly with further progress towards the 2% target a prerequisite for the first cut to be delivered.

The US economic calendar is busy besides just the CPI figures, with the weekly jobless claims report, latest UMich consumer sentiment survey, and March PPI data also all due. The latter will, perhaps, be of most interest, given that it, combined with CPI, can be used to produce a relatively accurate estimate of where the Fed’s preferred PCE inflation gauge will sit upon its release at the end of the month.

Speaking of the Fed, minutes from the March FOMC meeting are due mid-week, with any commentary around the balance sheet, and the end of quantitative tightening, likely to be of most interest, given the relentless play-by-play economic commentary that has been offered by speakers since that meeting. The pace of that commentary, incidentally, doesn’t slow this week, with another 9 FOMC members due to make remarks.

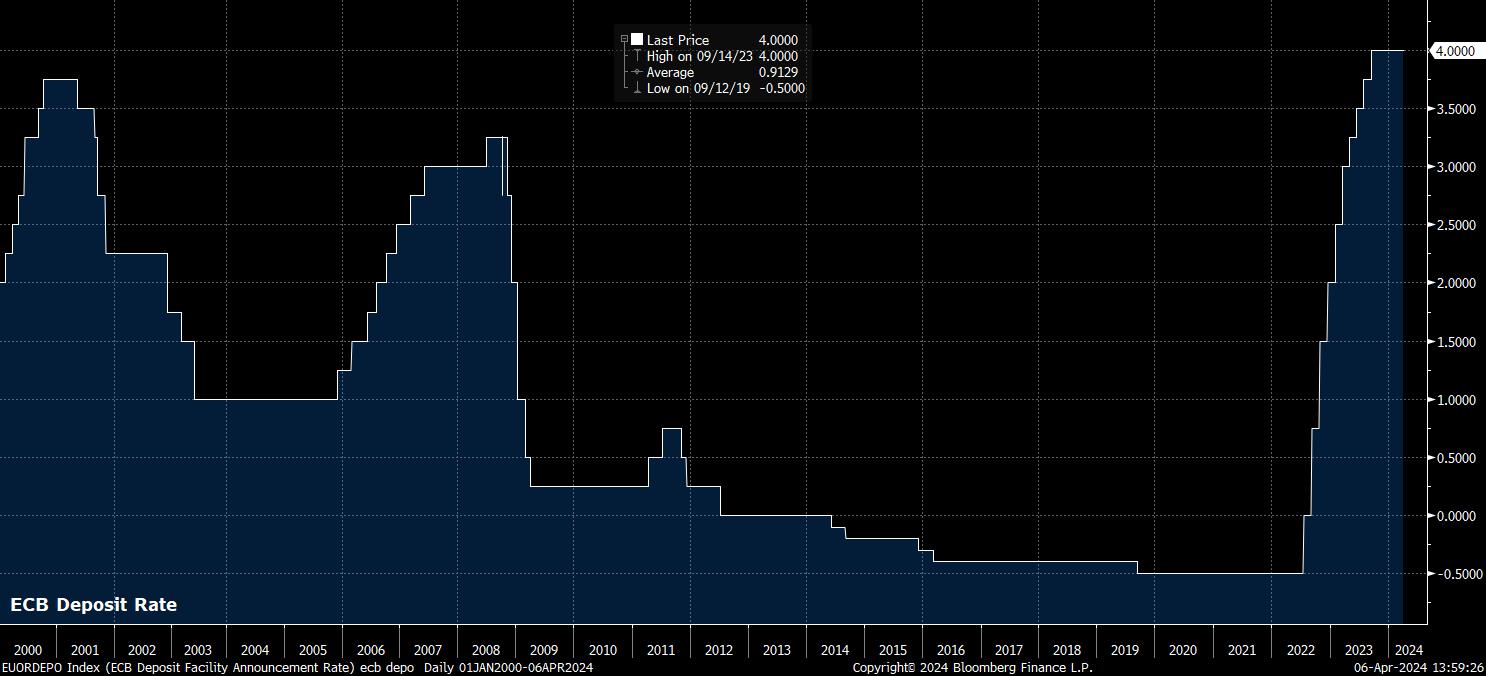

Away from the US, the monetary policy calendar is also busy, with decisions due from the RBNZ, BoC, and ECB.

None of the three are likely to alter policy at their upcoming meetings, hence focus will fall firmly on the guidance that policymakers issue around the matter of when the first cuts will be delivered. On that subject, the RBNZ have displayed a notable lack of urgency to cut up to now, sticking to a ‘higher for longer’ stance, that will likely be reiterated on Wednesday. The BoC, meanwhile, may begin to pivot in a more dovish direction, with the first cut likely to be delivered in June, and after a dismal March labour market report last week showed unemployment rising north of 6%.

Thursday’s ECB decision will also likely result in a relatively dovish policy statement, with Lagarde & Co. still on track to deliver the first rate cut in June, having effectively pre-committed to such a move at the March meeting. While any explicit commitment to a cut in early summer is highly unlikely, Lagarde will likely repeat that policymakers will know “a lot more” by that meeting, while perhaps also noting that they are almost sufficiently confident in inflation returning to the 2% target, particularly after the cooler-than-expected 2.4% YoY March CPI print last week.

Besides monetary policy, and economic events, this week also marks the start of Q1 US earnings season.

As is typical, the banks kick proceedings off, with JPMorgan, Wells Fargo, and Citigroup set to report before Friday’s market open. For reporting season as a whole, S&P 500 earnings growth is seen at 3.2% YoY, per Factset, which if delivered would mark the third straight quarter of YoY earnings growth for the index. Just nine S&P 500 constituents, including one Dow constituent (JPM), report in the coming week.

Despite this deluge of event risk with which markets must grapple over the upcoming trading week, and developments of last week, my overall market bias remains largely unchanged. Equities should continue to gain, with dips likely proving relatively shallow, with said gains likely boosted were earnings season to be a strong one. The Treasury curve, meanwhile, should continue to steepen, as the Fed’s 2% inflation target becomes a more flexible one, risks to the inflation outlook increasingly tilt to the upside, and Fedspeak leaves 2/3 cuts on the table this year. In turn, the dollar should remain well-supported, as US economic outperformance persists, and other G10 central banks pull the trigger on cuts before Powell & Co.

Related articles

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。