分析

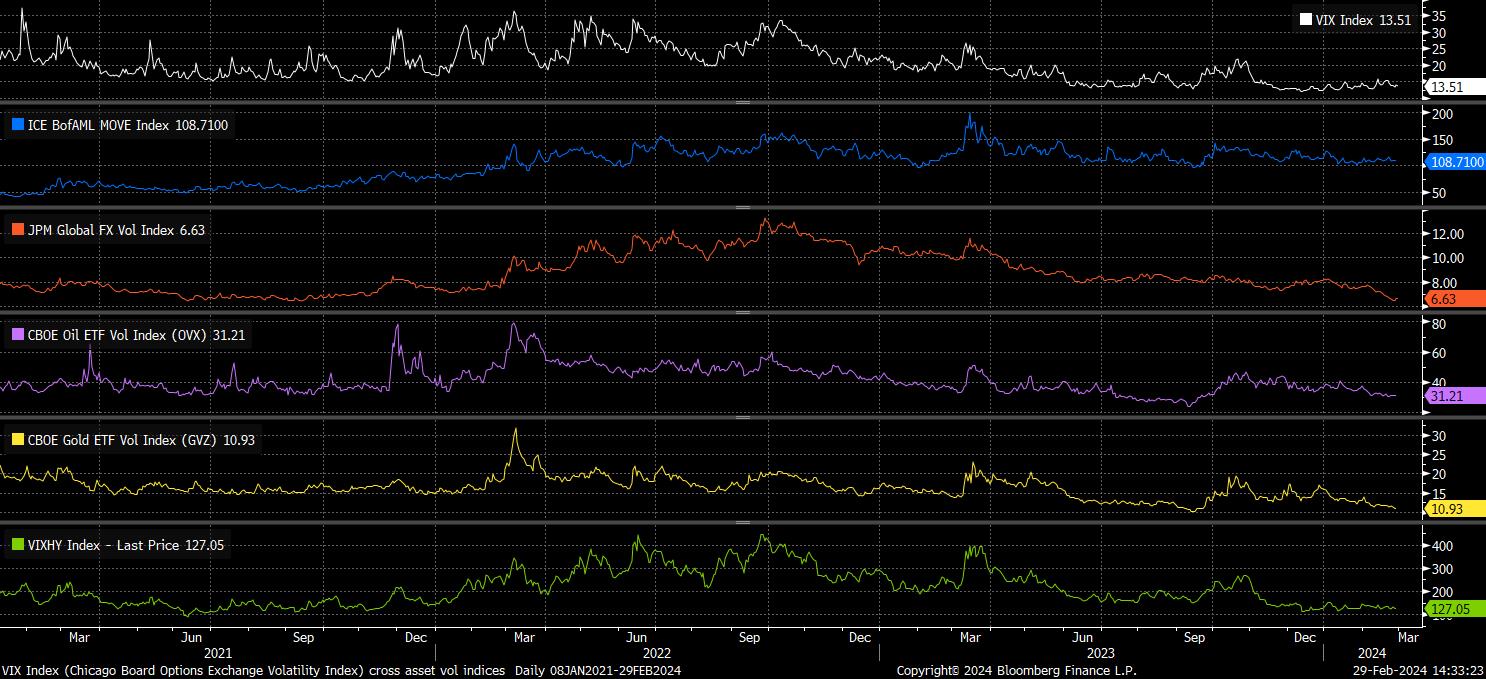

Firstly, to contextualise the current landscape, a look at a range of implied vol measures is worthwhile – the VIX trades with a 14 handle, below the 12-month average just shy of 16%; BofA’s MOVE index remains pinned at the bottom of its 18-month range; JPM’s global FX vol index sits at its lowest since 2021; while, implieds tracking both gold and crude ETFs have also slumped to fresh lows.

I see three reasons, or perhaps assumptions, as to why vol is at present so low.

Firstly, there is simply a lack of impactful news- and/or data-flow at present. Markets adeptly navigated NVDA earnings last week, and since, despite a high volume of headlines, there have been few of any note to significantly move the needle. Furthermore, the latest deluge of Fed speakers have pretty much all stuck to the now-familiar script, in that it will likely be appropriate to cut later this year, but that more data is required before doing so. In short, there’s been a lot of noise, but very little signal.

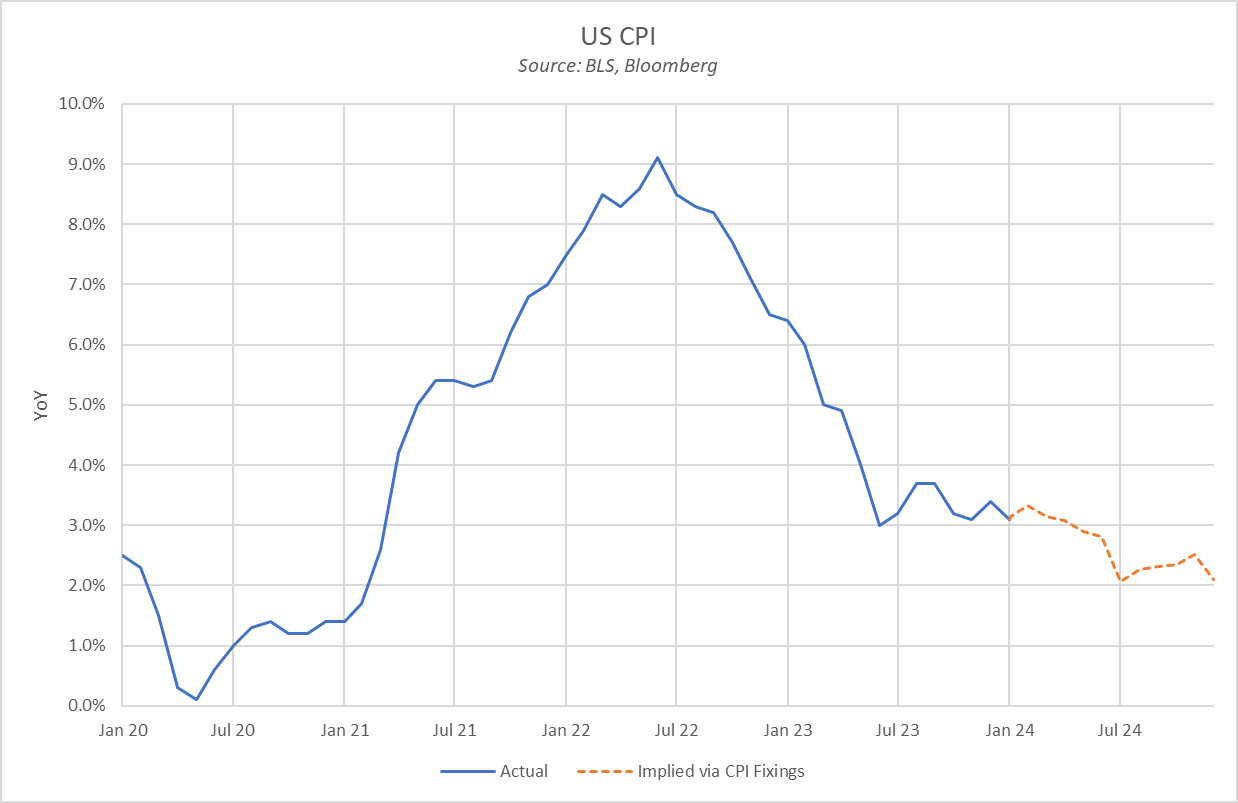

Secondly, is the assumption that disinflation will continue, albeit perhaps in relatively bumpy fashion, as the year progresses. The US CPI fixings market (shown below) evidences this well, though such disinflation will – as discussed at some length recently – require services disinflation to quicken, with fading price pressures in the goods side of the economy having done much of the heavy lifting thus far.

Thirdly, is the assumption that G10 central banks will begin to ease policy in the summer, and continue to move back to a more neutral stance over the following 12-18 months. Although USD OIS has priced out around 80bp of 2024 cuts since the turn of the year, the curve is still broadly in line with the aforementioned easing bias, albeit with the cycle beginning a few months later than had been expected six or seven weeks ago.

Given these assumptions, it is prudent to question the risks markets face, and the key dates that may influence said risks:

- Tight Labour Market: One of the biggest upside risks to the inflation outlook remains, globally, how tight the labour market remains, particularly with earnings growth remaining elevated, most notably in the UK, and the US. Were earnings growth to remain elevated, and labour markets to remain as tight as at present, upward inflationary pressures are likely. Naturally, the next US labour market report on 8th March will be the focus here

- Sticky Prices: As noted above, much of the hard work in the journey from double-digit inflation back towards the 2% target has thus far been done by disinflation in the goods side of the economy, with services prices having remained relatively sticky. Naturally, policymakers will want to see services disinflation accelerate, particularly with goods inflation having the potential to re-accelerate given the ongoing situation in the Middle East, and subsequent shipping delays/rising costs. After the January US PCE report passed without a hitch, attention will now shift to the next round of PMI surveys for leading indications as to whether price pressures are intensifying once more, followed by the February CPI/PPI figures mid-March

- ‘Higher for Longer’: Were upside inflation risks to prevail, and the jobs market to remain tight, one would naturally expect the ricing of rate cuts to be pushed back further into the summer, with the risk also that expectations for the easing cycle more broadly move from one of gradual, prolonged rate cuts, to a ‘short and shallow’ easing cycle akin to what was seen in the late-90s. Incoming Fedspeak, as well as the dots released after the March FOMC, will be key focuses here

- Geopolitics: Finally, geopolitical risk continues to linger, not only in the Middle East, but also with war continuing to rage in Ukraine, and with China-Taiwan relations remaining on shaky ground. Naturally, a knee-jerk risk-off move would be seen if any flare-up takes place in this realm, though at presents markets seem relatively immune to geopolitical headlines at present, with the rapid manner in which supply-induced spikes in crude are being faded epitomising this

In sum, though, unless and until the aforementioned risks do materialise, the supportive policy backdrop, and ‘goldilocks’ US macro landscape with a soft landing still on the cards, should keep the path of least resistance for risk assets leading to the upside.

Related articles

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。