分析

Certainly, USD pairs are getting a strong showing from clients, with breakouts seen in AUDUSD, NZDUSD, GBPUSD, EURUSD and USDCHF. We’ve also seen XAUUSD close at the highest level since July amid the nirvana backdrop of lower US real rates and USD weakness.

Trading breakouts is defined by strategy – momentum and trend-followers often enter positions on breakouts – other, more non-systematic players, will find it hard to trust the break and refrain from chasing, especially when we have the Fed meeting in play (06:00 AEDT / 1700 GMT), with the ECB, BoE and SNB out not long after.

What could go down?

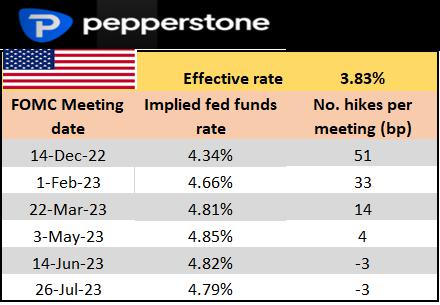

Rates Review – market pricing for each meeting

The Fed will hike by 50bp – I’d be shocked if we saw anything else and this action shouldn’t move markets given it's fully discounted – any move in the USD initially likely comes from algo’s reacting to the fed funds projection (or ‘dot’) for 2023, and perhaps for 2024. The current median projection, set at the September FOMC meeting, is 4.6%, but the debate is whether they lift this to 4.9% or 5.1% - one could easily argue that the Nov CPI print sways it towards 4.9%, which is where market pricing currently sits – subsequently should we see the 2023 ‘dot’ revised to 5.1%, in light of the CPI print, it could be seen driving to USD higher and causing equity and XAU to sell-off.

We can look at the ‘dot’ (or projection for the fed funds rate) for 2024 – currently, at 3.9%, the question whether they leave this unchanged or move this higher. Leaving the projection at 3.9% seems likely but it just validates the market's pricing of increasingly aggressive rate cuts through 2024.

You can see the current projection here - https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20220921.htm

The other factor is how open Fed chair Jay Powell – in his press conference - is to take another step down to hikes of 25bp pace at the February meeting – I find it hard to think he wouldn’t strongly open the door as there is so much evidence that US inflation is progressing to target. So, after another fall in the December CPI print on 13 Jan, the Fed should be able to hike by 25bp here – perhaps this will be the last in the series before a pause.

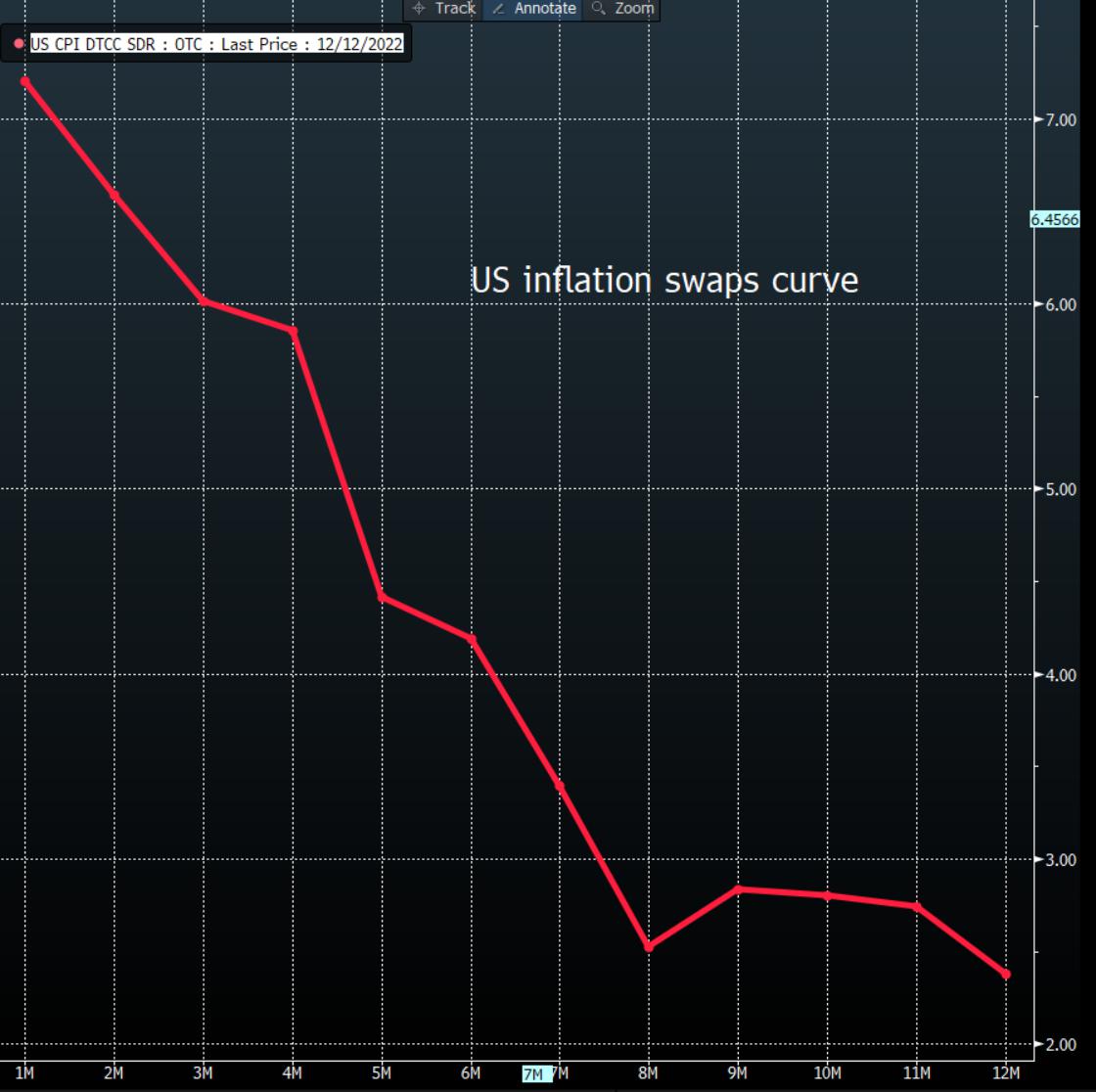

Inflation swaps pricing a strong trend lower in inflation

If I look at the inflation swaps market, I find it interesting that traders are betting that inflation falls below the fed funds rate by March – this is a punchy call, but this is exactly what the Fed want to see, and they have made it clear they want to take fed funds above underlying inflation. We can look further out the inflation swaps curve and see the market pricing headline inflation at 2.37% in late Q4. As I mentioned in the 2023 traders’ outlook, high inflation is likely going to take a backseat to growth concerns, and the Nov CPI print gives that view additional support.

A more dovish Fed in 2024

Another factor which needs to be considered is the rotation in voting FOMC members in 2024 –the way the committee is evolving clearly favours the bond bulls/USD bears. Notably, we see, James Bullard, Esther George, and Loretta Mester – these are 3 of the 6 hawkish Fed members who in September projected a fed funds rate of 4.9% for 2023 and are now calling for well above 5%, are to be replaced by Austan Goolsbee (Chicago Fed), Lorie Logan (Dallas Fed) and Patrick Harker (Philadelphia Fed) – voters who lean more on the dovish side of the ledger.

Economics and markets are dynamic – they evolve – the Fed are still very much reactionary and wants to see strong evidence of inflation headed lower and they should be seeing the evidence build by the day. Market players feel confident Powell won’t want to deviate too greatly from his statement at the Nov FOMC meeting and understand now is not the time for high-fiving and claiming victory on inflation – but he should give them maximum flexibility to take the pace down to 25bp, knowing that growth will likely slow for here and prior rate hikes still need to work their way through the system – Powell will need to hit a home run on his communication – it promises to be very insightful and will set a stage for 2023.

Related articles

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。