分析

Equities are marching higher led by cyclicals, and banks finding a better tone with bond yields reversing higher and earnings due out.

The USD will always get a strong look from clients and if US bond yields continue to push higher into 1.40% (in 10s) – a big ‘if’ when June CPI is due, Fed Chair Powell testifies twice and the US Treasury Department issue a significant amount of debt, then the USD should find buyers but specifically vs the JPY and CHF.

Watch USDCNH, as this has been the poster child of reflation bets and if it heads lower then commodities should find a positive tone – Copper goes square on the radar, as solid China data should resonate in upside for $4.46. Gold bulls need a break through 1814 (the 38.2 fibo of the June sell-off) to see the bullish momentum continue and traders then need to ask whether trading Gold in USD is always the best trade given the USD risk this week.

US corporate earnings should get a greater focus from clients too, while the macro will dominate the reporting season should be a largely positive affair and close to 80% of companies should beat on the bottom line.

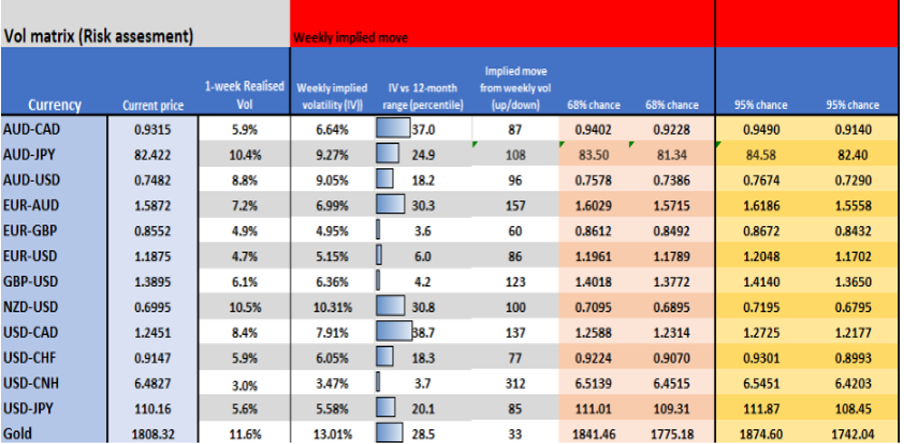

Implied volatility matrix – here we see the weekly implied volatility (sourced from Bloomberg). This is a key input when pricing options and it offers insight as to whether traders see greater movement ahead. Given the number is an annualised number, we can understand the weekly implied move here – which I have projected on current spot levels to give me a 1 and 2-standard deviation range. It gives a sense of expected movement over the week with levels of confidence.

I find this useful for risk management, position sizing and also for mean reversion purposes.

What’s on the radar this week?

US

13 July (22:30 AEST) – June CPI, the consensus is for headline prices to rise 0.4% MoM, 4.9% YoY, 4% core inflation. This should be one of the marquee events of the week. if headline inflation prints north of 5% we should see the USD go bid and USDJPY pushing towards 111, where I’d be inclined to fade rallies above the figure on the week.

13 July – (03:00 AEST) – US Treasury to sell $38b in 10yr notes. Treasury auctions have generally resulted in higher US bond yields, and should the bid-to-cover ratio come in above 2.6x then higher yields could see the USD working well.

15 July (02:00 AEST) – Fed chair Powell delivers a semi-annual testimony to the House panel. Also testifying again to the senate at 23:30 AEST. Watch USD and Gold exposures over this period.

16 July (22:30 AEST) – Retail sales – the consensus is for sales to fall -0.4% or +0.4% ex-auto - always a keenly watched data point, but unless it proves to be a huge beat or miss it shouldn’t be a volatility event.

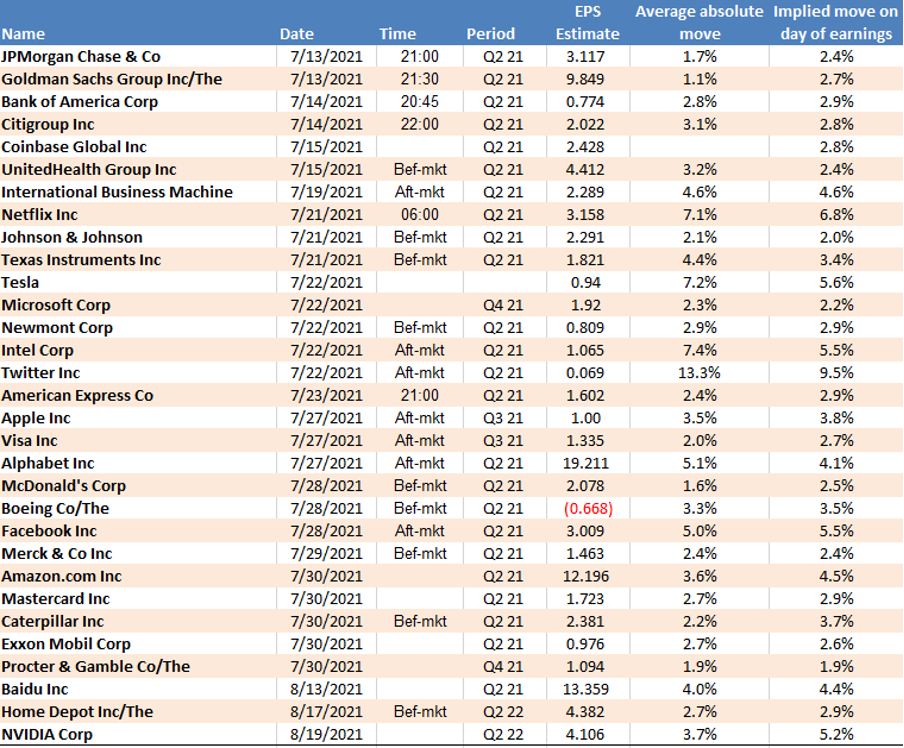

Earnings – As per our earnings calendar, we see the US banks reporting numbers – on Tuesday Goldman’s (consensus EPS $9.92, revenue $12.29b) and JPM (EPS 3.11, rev $30.03b) get the ball rolling.

China

13 July (no set time) – Trade balance – there are several leading indicators that suggest China’s export numbers should be solid. Given the recent moves to stimulate, perhaps it’s the more inwardly focused import numbers that may get more attention.

15 July (12:00 AEST) - Q2 GDP (consensus +1% QoQ, +8% YoY. We also get retail sales (consensus +10.9% yoy), industrial production (8%), fixed asset investment (12%). The failed break of 6.4800 in USDCNH seems key and if the cross heads lower then it should put a bid in risk assets more broadly – a push down towards 6.4600 and AUD should outperform. Watch Copper as suggested.

Australia

15 July (11:30 AEST) – Aussie June employment (consensus 20k, participation rate 66.2%, u/e rate 5%) - AUDUSD weekly implied volatility sits at the 18th percentile of the 12-month range, putting the expected move over the week at 95-pips (with a 68.2% level of confidence). With the RBA having delivered its recent policy statement and just over three hikes priced into the rates market over the coming three years, we need a series of new data trends to fuel a major change in rates pricing and the AUD. The jobs data may be a short-term event and it should offer mean reversion traders’ levels to fade any punchy move on the day. I like AUDNZD lower.

UK

14 July (16:00 AEST) - June CPI – Consensus 0.2% mom, 2.2% yoy

15 July (3:00 AEST) - BoE Ramsden speaks, then BoE Saunders speaks (8pm)

15 July (16:00 AEST) - ILO unemployment rate, claimant count rate

Canada

15 July (00:00 AEST) – BoC policy decision – Implied vol is fairly low, and may push higher, but traders’ are not expecting major changes here. USDCAD is a tough call this week given Friday’s price action – favour a move to 1.2350 but have no position. A bullish break above 1.2470 would not go unnoticed.

NZ

14 July(12:00 AEST) – RBNZ policy meeting. We’ve seen calls (from economists) for the RBNZ to hike this year and the interest rates markets have responding, with around a 75% chance of a hike priced in over the coming six months. This makes the NZD rather attractive, but we also need to consider what is already discounted.

16 July (08:45 AEST) – Q2 CPI – (consensus expects 0.7% mom, 2.7% YOY)

做好交易準備了嗎?

只需少量入金便可隨時開始交易。我們簡單的申請流程僅需幾分鐘便可完成申請。

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。