Some basic information about ANZ

ANZ stands for The Australia and New Zealand Banking Group Limited. The short code is ANZ. They are Australia’s second largest bank by assets and fourth largest by market cap. We are going to break down ANZ share price from a fundamental and technical standpoint.

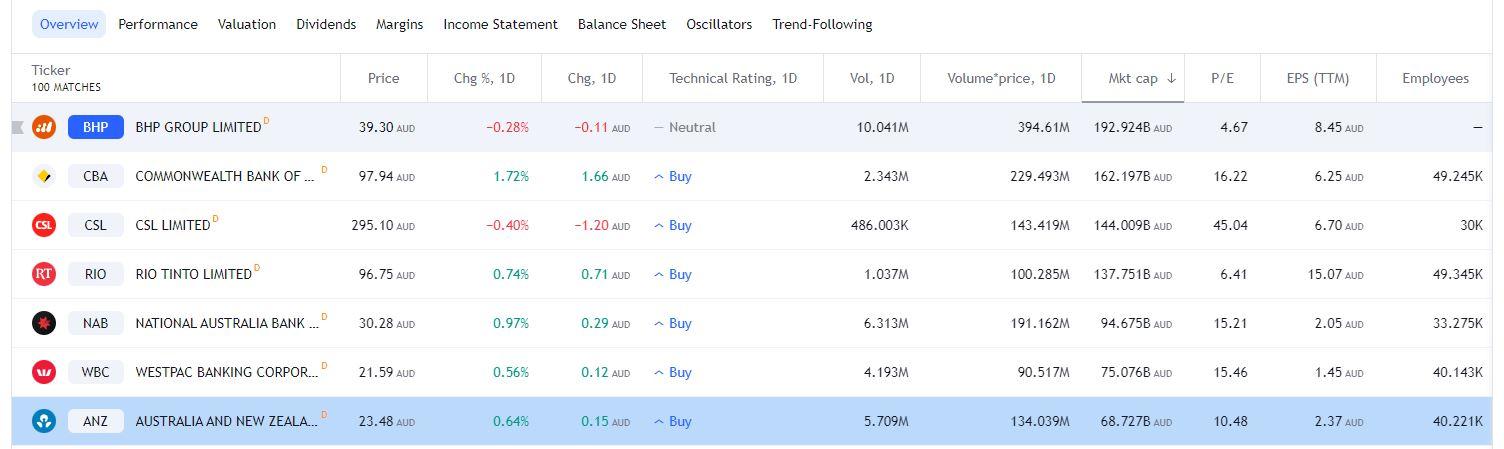

Figure 1 Trading View ANZ Market Cap

The 2020 rally in the ANZ share price

The Australian Banking sector performed robustly in 2020, and ANZ was no exception to this rule. ANZ shares witnessed a rally of +110% from the March 2020 low of 13.99 AUD to the high print of 29.41 AUD in June 2021.

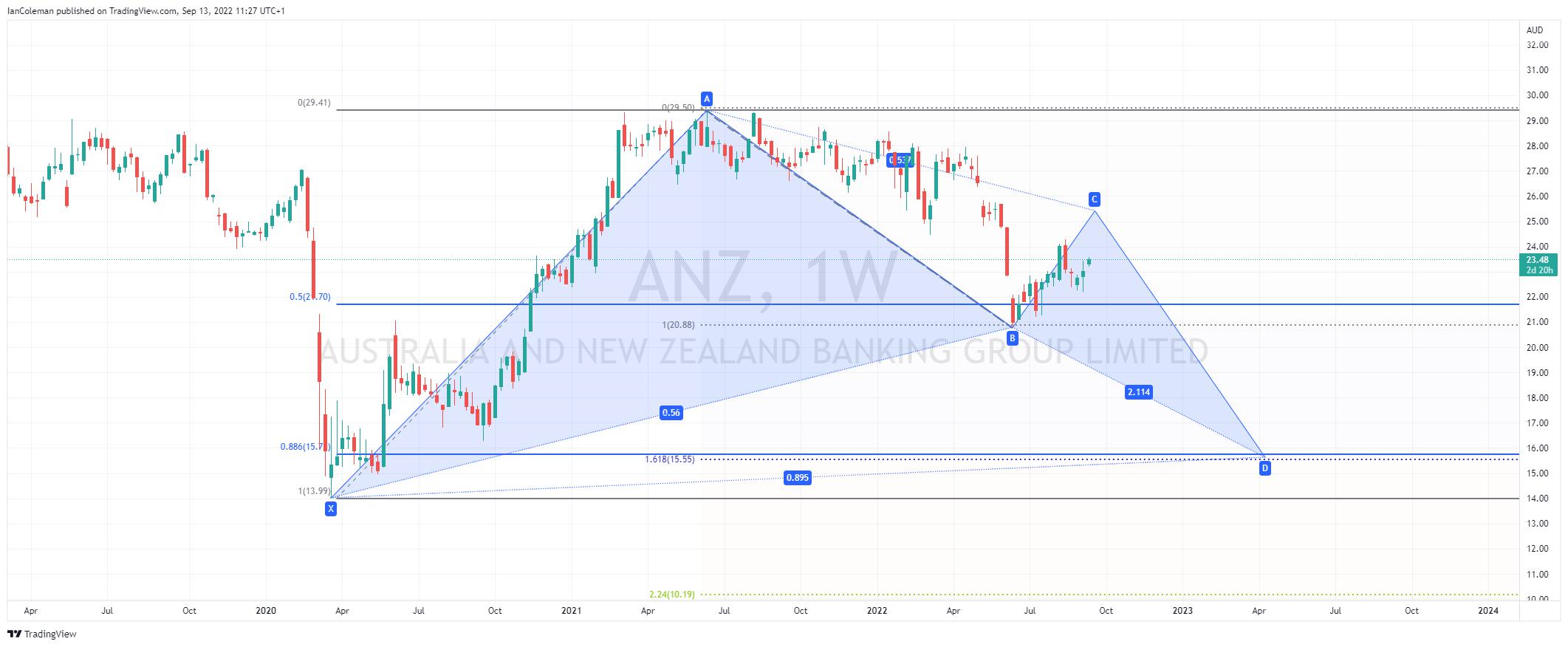

Figure 2 Trading View ANZ 2020 rally

It should be noted that ANZ has only beaten earnings expectations twice in the last 12 reports. The next report is due on the 22nd of October 2022.

The 2022 half year results were published on the 4th of May 2022, just before the last decline in the ANZ share price.

ANZ announced a Statutory Profit after tax for the half year ended 31 March 2022 of $3,530 million, up 10% on the previous half. Cash Profit from continuing operations was $3,113 million, down 3% when compared with the prior half. ANZ’s Common Equity Tier 1 Ratio was strong at 11.5% and Cash Return on Equity was 10%. The proposed Interim Dividend is 72 cents per share, fully franked.

A look from a technical perspective

Looking at the monthly chart from a technical perspective, we can note an Expanding Wedge pattern. This has an eventual bias to beak to the upside. Trend line resistance is currently located at 28.07. A breach there, and the measured move target is 39.96.

Figure 3 Trading View Monthly ANZ Expanding Wedge

We have seen a move to the upside from levels close to 21.05. This was a previous swing high from June 2020. What acted as resistance, now acts as support.

Figure 4 Trading View Weekly ANZ 21.05 being pivotal

A look from an Elliott Wave perspective, and the last move higher can be seen in 5-waves. That would suggest that the current move lower is corrective.

Figure 5 Trading View Weekly ANZ 5-wave pattern

Corrective formations are normally in a 3-wave pattern. There is the potential for a bullish Bat Cypher formation to complete between 15.71 and 15.55.

Figure 6 Trading View Weekly ANZ Possible Bat formation

Related articles

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。