差價合約(CFD)是複雜的工具,由於槓桿作用,存在快速虧損的高風險。80% 的散戶投資者在與該提供商進行差價合約交易時賬戶虧損。 您應該考慮自己是否了解差價合約的原理,以及是否有承受資金損失的高風險的能力。

Some basic information about Westpac

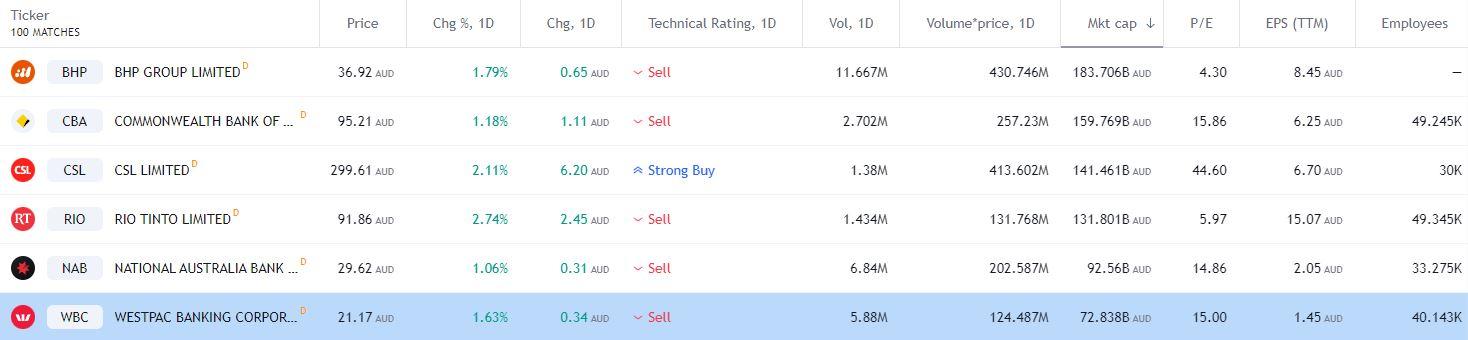

Westpac Banking Corporation, short code WBC, is the third largest bank in Australia by market cap, trailing behind the Commonwealth Bank of Australia and National Australia Bank.

Figure 1 Trading View Market Cap

Referred to simply as Westpac, they are known as Australia’s First Bank and employ over 40 thousand people.

The rally from 2020 lows

The Westpac share price performed well with a rally of just over 100% from the 2020 low of 13.47, to the June 2021 high of 27.12.

Westpac Share Price Monthly Chart

Figure 2 Trading View Westpac 100% increase

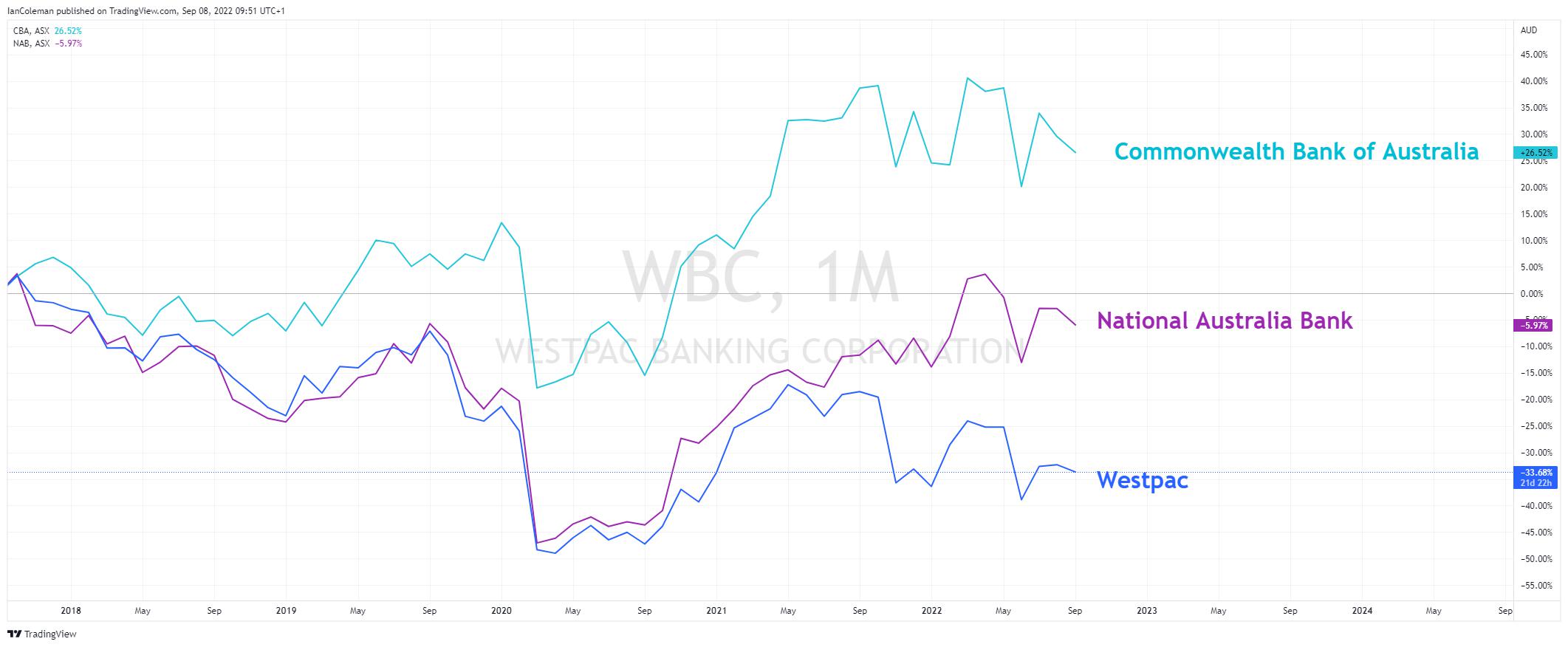

But how did the Westpac Share Price perform against its peers?

The Australian Banking sector has seen a broad-based rally from the 2020 base. In the chart below we can clearly see Westpac underperforming against the likes of Commonwealth Bank of Australia and the National Australia Bank over the same period.

Figure 3 Trading View Banking Sector performance

A look from a technical perspective

A look at the weekly chart and we see two dramatic moves to the downside. The first occurred in the week 1st November. This was after earnings missed by a dismal -5.3%. The second occurred when the RBA, The Reverse Bank of Australia, stunned the market with a higher-than-expected interest hike of +50 basis points. This was the biggest hike in 22 years and took the rate to 0.85%.

Westpac was one of the first big banks to pass on the full increase to its variable home loan customers.

Westpac Share Price Weekly Chart

Figure 4 Trading View Weekly declines

Where to now for the Westpac Share Price?

The choppy and erratic price action in the Westpac share price has resulted in an Expanding Wedge being posted on the weekly chart. Although this formation has a mild bias to break to the upside, there is ample scope for a move in either direction in the short term.

Westpac Share Price Weekly Chart

Figure 5 Trading View Westpac Expanding Wedge

One possible support level to watch is 16.41. That would form a bullish technical cypher pattern known as a Gartley – 222. The next earnings report is due on the week 6th of November.

Westpac Share Price Weekly Chart

Figure 5 Trading View Westpac Gartley

Related articles

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。