Analysis

Perhaps just as interesting is how calm broad markets have been and maybe that’s because Q3 earnings have been impressive or that US Treasuries have not repriced anywhere near the same extent as others in DM.

However, there's been no movement in equity volatility (vol), and outside of an 8% decline in NatGas, commodities and FX have been calm too.

The UK and NZ have been the backbone of the move, but the net result despite all the vol in the front-end has been fairly sanguine conditions in FX markets - with GBPUSD 1-week implied volatility unchanged at 6.45%, despite UK 2-year gilts closing at 72.3bp, up a staggering 14bp on the day. We see UK swaps markets pricing 36bp of hikes into the 16 December meeting, so a hike on 4 November is almost a done deal with a second a coin toss – we go further out and see 3 more priced for 2022. The FTSE100 closed -0.4%.

GBPUSD has even traded lower despite this pricing, hitting 1.3709 and supported at the 50-day MA. EURGBP has seen solid short covering trading up nearly 50 pips to 0.8463, where a squeeze higher into 0.8480 may look ripe for fresh short positions. The EUR finding some support, as German 2-year yields rose 5bp to -62bp. In fact, we can now see the market pricing the ECB lifting rates by 10bp at the end-2022 and I know there will be many cynical on that position.

We can work out way through the GBP pairs, but there has been limited appetite to go after the GBP despite the repricing of rate expectations in the wake of BoE Bailey’s comments that the bank “may have to act” yesterday. The flatter UK bond curve may partially explain some of this, with the UK 2s vs 10s yield spread lower by a sizeable 10bp to 41bp. In contrast, the US 2s v 10s yield curve is -0.5bp

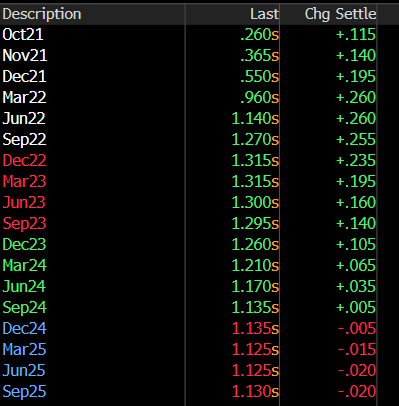

We can look at the UK interest rates curve, and hike expectations peaking in June 2023, before yields in the quarters ahead grind lower – does that in some way signal a policy error from the BoE?

short sterling futures – UK rates pricing

(Source: Bloomberg - Past performance is not indicative of future performance)

NZ rates went wild yesterday after the 4.9%-decade high lift in CPI and in turn this set off Aussie rates, with NZ 2-year govt bonds closing up a monster 24bp. A hike in the 24 Nov RBNZ meeting is not just a lock, in fact, there is 51% chance we see a 50bp hike. The NZD is the top performer here, but the moves are modest with NZDUSD trading a 0.7105 to 0.7050 range. NZDUSD 1-month implied vol is up only very slightly to 8.88%, so the market is not seeing the rates pricing leading to a markedly higher volatility regime.

In Australia, we’ve seen 3-year govt bonds close +19bp to 78.3bp, with 10yr govt bonds +9bp and we’ll watch for follow-through here today. A rate hike is now priced for August 2022, with at least four hikes priced over the coming 2 years. There has been indecision to translate this move higher in AUD, perhaps also partly down to the lousy tape in Chinese markets, with the China A50 index -2.2%, and small sellers in USDCNH. AUDJPY has been the momo beast of late, and again despite the repricing in the front-end of the bond curve AUDJPY has failed to push above 85.0.

Aussie rates are screaming out that the RBA is going to move on its forward guidance, any day now – will the RBA stick to their resolve? The market wouldn't be surprised to hear a small tweak in a statement or even a journalist close to the RBA prime the market for a change. Perhaps we’ll hear something in today's RBA minutes?

The US, as always are the price maker in the market and we’ve only seen a small move higher in US yields and as I mentioned is the picture of calm in the fixed income markets. The interesting factor amid the evolution of the market's pricing on interest rates and inflation dynamics is that Jay Powell’s odds of being reappointed as Fed Chair have not been lower, even if the probability is that he will get another term. This is not really a time for uncertainty as the US embarks on tapering its asset purchase program and members upgrade their view on inflation towards sticky, amid a debate within the Fed’s ranks as to whether the labour force participation rate is due to rise as the many job vacancies are filled, or whether the tightness continues in a more structural fashion leading to even further wage increases.

A divided Fed

Let's not forget that the view on the Fed is incredibly split and this poses a risk in itself. Take the 2024 ‘dot’. The median call was 1.75% on the fed funds rate, but there were 10 calls for the Fed funds rate to be between 0.63% and 1.645%, with the median being 1.1%. Of the 8 hawks who gave projections the range was 2.63% to 1.87% - the median being 1.75%. Powell or Brainard will need to bring that view together somehow or this could pose a risk longer-term to markets.

For now though, it's impressive how resilient and calm markets are in the face of the rates repricing. We also ask, have the moves gone too far and are expectations too rich now?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.