Analysis

The GBP trader - the concerning message the rates markets portrays about the UK

Granted, that’s a long way off and forecasting is incredibly hard at the best of times – but the market does what it does – it assesses the distribution of probabilities and weights them accordingly.

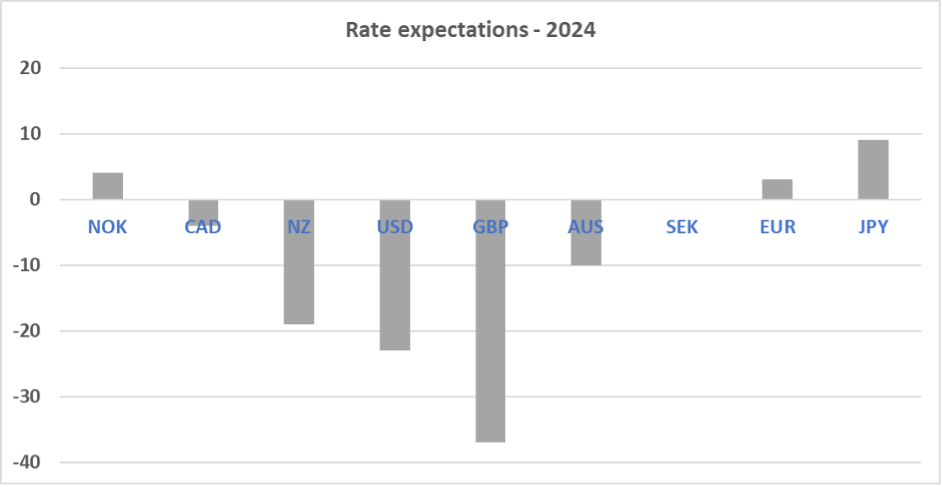

Number of hikes/cuts priced (in basis points) in 2024

(Source: Pepperstone - Past performance is not indicative of future performance.)

What's interesting is the market pricing in UK rates in 2024. Granted, the MPC has been outspoken as any on the ever-growing risks of stagflation. We’re now being told the BoE may not indeed proceed with QT and asset sales if conditions became difficult - subsequently becoming the first G10 central bank to install the conditions for a genuine policy pivot.

BoE Gov Bailey is clearly worried about the unfolding food crises in the UK and Brexit is not only contributing to inflation but has deeply impacted UK trade, notably, SME export volumes. We’ve still got to fully price Downing Street amending parts of the Northern Ireland Protocol and reigniting tensions with Europe.

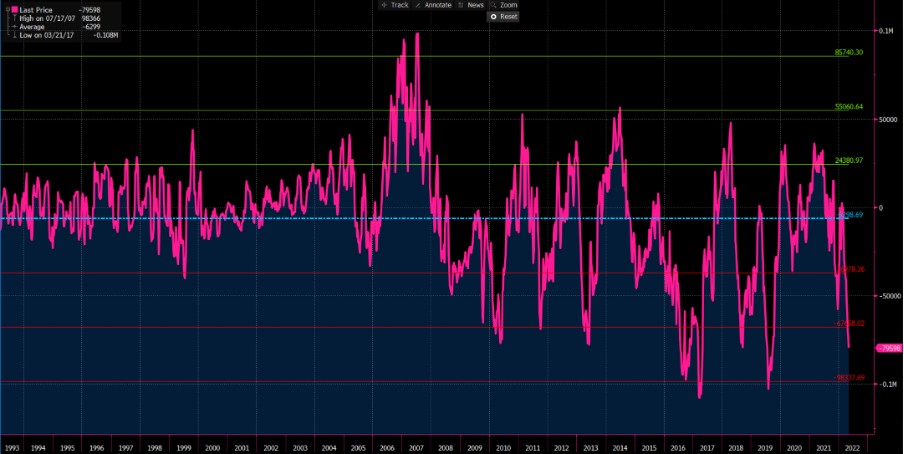

Weekly CFTC report – non-commercial account short 79k contracts

(Source: Bloomberg - Past performance is not indicative of future performance.)

The UK holds the deepest negative real (inflation-adjusted) bond yields, a factor which comes and goes as a headwind, keeping the GBP suppressed. However, when we mix in deteriorating growth prospects, very high and sticky inflation and rising political concerns, and a central bank who not started its hiking cycle earlier than others, but may look to end it sooner and you can see why leveraged funds have been sellers of GBP and why we see non-commercial GBP positioning (CFTC report) at -79k contracts, not far off the record lows seen in 2019 (-108k contracts).

The consensus (median) forecast from FX strategists for end-Q2 is 1.2600, but I wouldn’t read too much into that. The question we hear more about is whether a new bout of USD strength can take GBPUSD through 1.2000? Using a basic options distribution model, I see the current implied probability of reaching 1.2000 in a month at 16.8% - so the market sees it as a tail event but it’s by no means out of the question – this probability pushes to 25% if we take the time frame out to 3 months.

The questions I ask then:

- With the market so short of GBP what could cause a lasting short squeeze, or is this a taste of more to come?

- Could GBP shorts be the best hedge against a further global economic downturn? Is that what the increasingly growing rate cut position 2024 is portraying?

It certainly feels to me that both the rates pricing for 2024 and increasing net short positioning are telling us that if we’re looking for an area of increasing concern it’s the UK. Until equity markets see a sustained upturn the idea of targeting 1.2000 and below in the coming months seems a solid risk.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.