Les CFD sont des instruments complexes et présentent un risque élevé de perte rapide en capital en raison de l’effet de levier. 72.2% des comptes d’investisseurs particuliers perdent de l’argent lorsqu’ils investissent sur les CFD. Vous devez vous assurer que vous comprenez le fonctionnement des CFD et que vous pouvez vous permettre de prendre le risque élevé de perdre votre argent.

- Français

- English

- Español

- Italiano

Like most, I had expected tweaks to the statement of ‘sometime’ before substantial progress was made, so the fact this remained in the statement speaks to the dovish lean. Price pressures considered ‘transitory’ was a common theme and in essence, all you really needed to hear was that the Fed is not talking about tapering. As well as knowing that you could save yourself 60 minutes of your life reading the statement and listening to the press conference.

I've put together a video explaining what went down and the reaction, and some key dates for your diary. Do watch the video here.

While clients tend to hold positions for around 80-90 minutes on average (depending on the asset class), it's worth understanding the timeline for tapering and as we head into the weeks ahead, you're going to hear the words “Jackson Hole” come up a whole lot more. It feels incredibly likely that if we’re to see higher vol in markets and that includes crypto, that's likely going to be in the weeks leading into the Jackson Hole Symposium in late August. In Powell we trust, although I for one am pro-volatility.

We have also seen some blockbuster numbers from Apple and Facebook, and again I touch on those – will Apple show signs of leadership within the index, which has been missing for a while? The numbers seen from the tech giant were nothing short of exceptional and I’m surprised it's ‘only’ up 3% in after-hours trade.

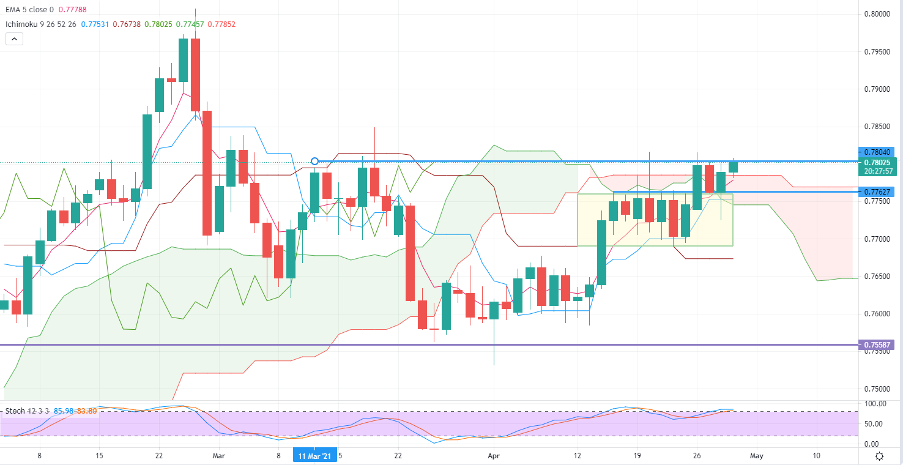

(AUDUSD daily)

(Source: Tradingview)

I'm still long EURJPY as an idea and holding for now, and watching for AUDUSD to break 0.7800.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.