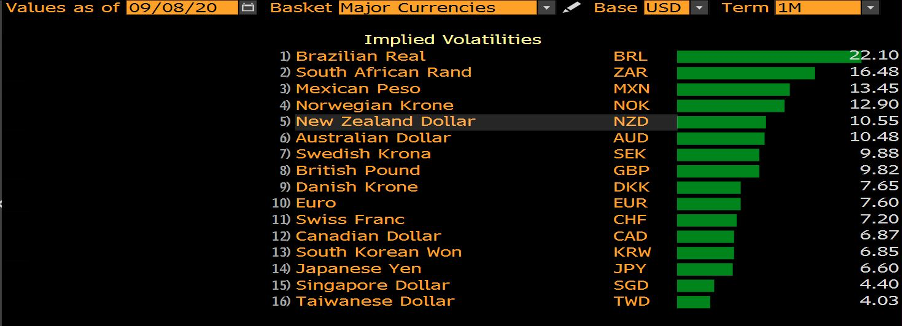

As we touched on in the note yesterday, the focus has turned to EU and UK trade talks and the market has got a touch excited about movement. Where we see cable 1-month implied vol moving to 9.82%, the highest since 30 June. As we get closer to the 15 October EU Summit and deadline, I suspect vols will increase.

GBPUSD has been the weakest link in G10 FX and sits at 1.3168, having been as low as 1.3141 and resides at the 22nd percentile of the sessions trading range. Although to be fair, nothing has happened through US trade and we see price just meandering sideways. This won't surprise given the US equity and bond cash markets have been closed for Labor Day. As suggested yesterday, like many I'm keen to understand if the GBP trades more as a political currency. Just as it did throughout 2019 and not as a risk vehicle to express market sentiment similar to the AUD. The rising 1-month implied volatility suggests that may well play out, although vols still trade at a discount to AUD, NZD and NOK. So there's a limited political premium built into price.

(Source: Bloomberg)

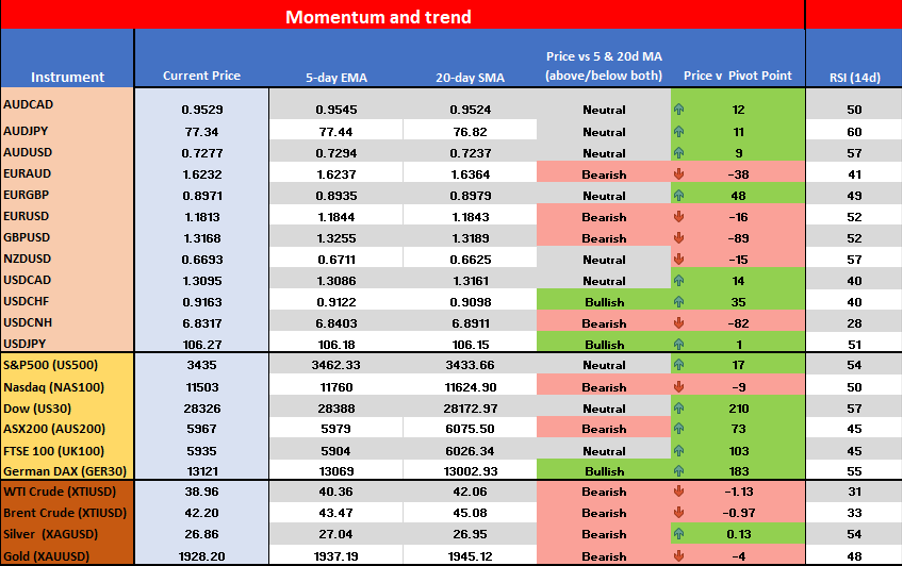

At a simplistic level, if I work on the notion that GBPUSD holds both below the 5-day EMA and 20-day SMA below the pivot point and sits towards the session low, it makes it tough to be long GBP. This offers risks that we see 1.3050 in play, although that call will be validated if price can crack 1.3141. Conversely, given the current bearish trend developing, the risk on any rally is for sellers to fade moves into the 5-day EMA.

I have put this simplistic matrix together using Excel RTD (Smart Trader Tool), which is pulling out data from MT4 and just set conditional formatting to show if the price is above or below both MAs. if you’re a client you can do this fairly easily. Just reach out and I’ll send a guide.

If I look at the CFTC weekly futures positioning report (CoT), I see both asset managers and leveraged funds running incredibly neutral in GBP futures and it would be a battle with AUD for the most neutral setting in G10 FX positioning. This is also true of ETF flow where the net flow (into UK ETFs) has been balanced.

(Top pane – positioning held by leveraged funds, lower – asset managers)

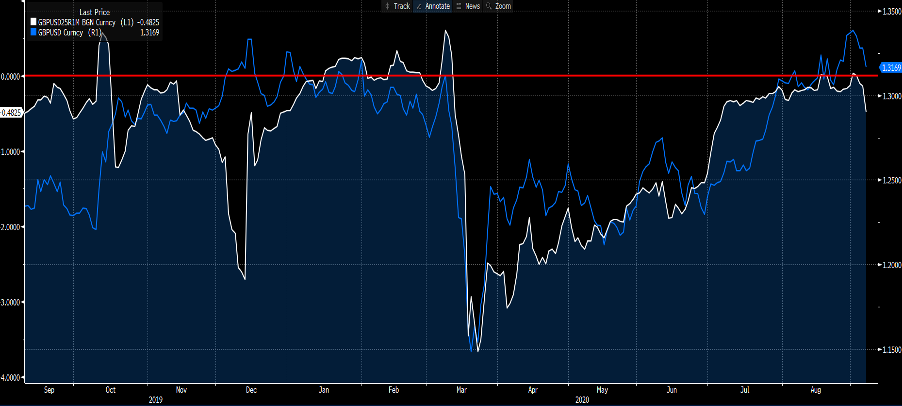

What I'm watching are GBPUSD 1-month risk reversals and they are starting to move lower, which shows traders have been better buyers of put option volatility (over calls). This typically gives me some of the best visuals on sentiment. There are many ways to assess the GBP as a political currency and the extent of the political premium priced into the currency. Right now it’s very low – I suspect that will change.

(Blue line – GBPUSD, white – 1-month risk reversals)

EURGBP makes interesting viewing and trading this week, notably with the ECB in play. On the session we’ve seen buyers with a high of 0.8993, which is actually a fairly sharp move given price reached the R3 (pivot points) and the 20-day MA. In any other condition I would start to fade rallies in this pair here, given this looks like a mean reverting move that has played out. But with rising GBP implied volatility driven by concerns of political shenanigans, it lowers my conviction sufficiently that I won’t be involved.

Fundamentally, we know UK-EU talks are starting today with the market reacting to the FT report of an internal market bill which could undermine or water down the Brexit withdrawal treaty. But if I look at the dynamics, I see expectations are low for a breakthrough in this week’s trade talks (small GBP positive), but the news flow will hardly entice GBP buyers and seems unlikely to show convergence between the two parties (GBP negative). EUR positioning stands at record highs while GBP is neutral (small GBP positive). We have the ECB meeting on Thursday and Christine Lagarde will prepare the market for further easing and should be cognisant not to give fuel to EUR bulls - the FX risk here is symmetrical.

So, my incredibly simplistic EURGBP fundamental playbook suggests EURGBP risks are skewed both ways and there is no easy trade – when are they ever?

USDCHF looks the better trade for me. It’s one that has been on the radar, but price action is shaping up nicely and a move through 0.9160 would raise the prospect this starts to trend.

做好交易准备了吗?

只需少量入金便可随时开始交易。我们简单的申请流程仅需几分钟便可完成申请。

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。