The Daily Fix: The USD breaking its breakout, and the driver is the bond market

That said, crowd favourite Tesla (-closed -5.6%) hasn’t taken part with Elon Musk lowering expectations ahead of the Battery Day presentations, which is expected out shortly.

Going cross-markets and commodities are steady. Gold closed -0.6%, and is just holding $1900, copper is +1.3%, crude +0.5%, lumber is flying +5.3%, and iron ore futures -0.3%. We see bond markets unmoved, where we have to head right out of the Treasury curve to see 10’s and 30s +1bp, while inflation expectations (i.e. ‘breakevens’) are down 2bp. Credit markets are largely unmoved as well, while the VIX – if we want to look at volatility is -0.9 vols at 26.86%, suggesting daily moves of 1.7% in the US500.

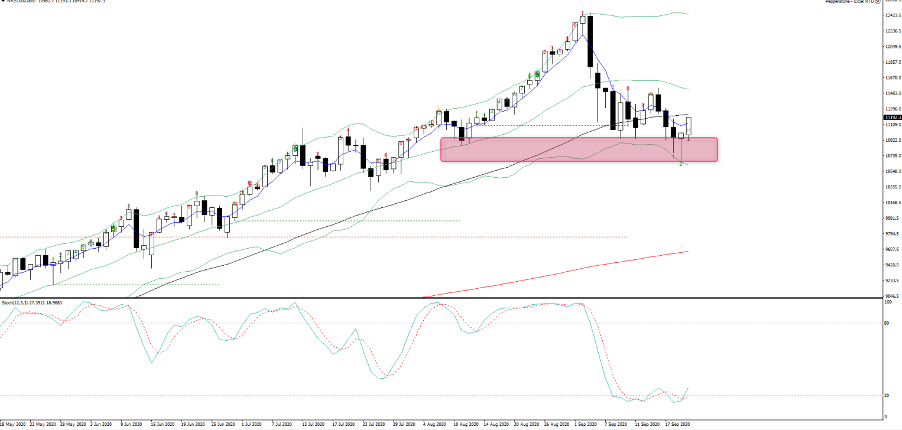

But the story I'm seeing is that it’s all USD buyers out there in the big bad world of FX markets and while the USDX is up just 33bp (or 0.33%), the moves are broad-based. The March downtrend in the USDX has firmly given way and price is holding above the 5-day EMA which has started to turn higher. Price is also above the 50-day MA and looking at breaking free of the range highs. A closing break here looks pivotal ST to the USD.

In the options space, traders are better buyers of USD call volatility buying (relative to puts), while EURUSD 1-week risk reversals are trading negative for the first time since June. So traders, now on balance, feel that when there is movement the downside movement will be marginally more pronounced than upside.

Some of the USD moves can be attributed to positioning. We know the world has been short the USD, especially asset managers exposures to EUR futures. Many have attributed the USDX move to comments from Chicago Fed President Charles Evans who said “we could start raising rates before we start averaging 2%”. The comments have coincided with the leg higher in the USD. Although, when calmer heads really lay into this, most see them as a poor choice of wording, and he did put them in the context where core inflation is rising. He also mentioned that long-end bonds were “quite low”, so this lowers the need for QE or yield curve control. To be fair, when we consider the recent economic projections (in the September FOMC meeting) and the consistent undershoot seen in future PCE inflation estimates - unless we’re genuinely surprised then I think Evans is really talking up a late 2024/25 story anyhow.

The fact we’ve seen pricing out of rate expectations and literally no move in the US 2-year Treasury backs up the claim that Evans’s comments are not a game-changer.

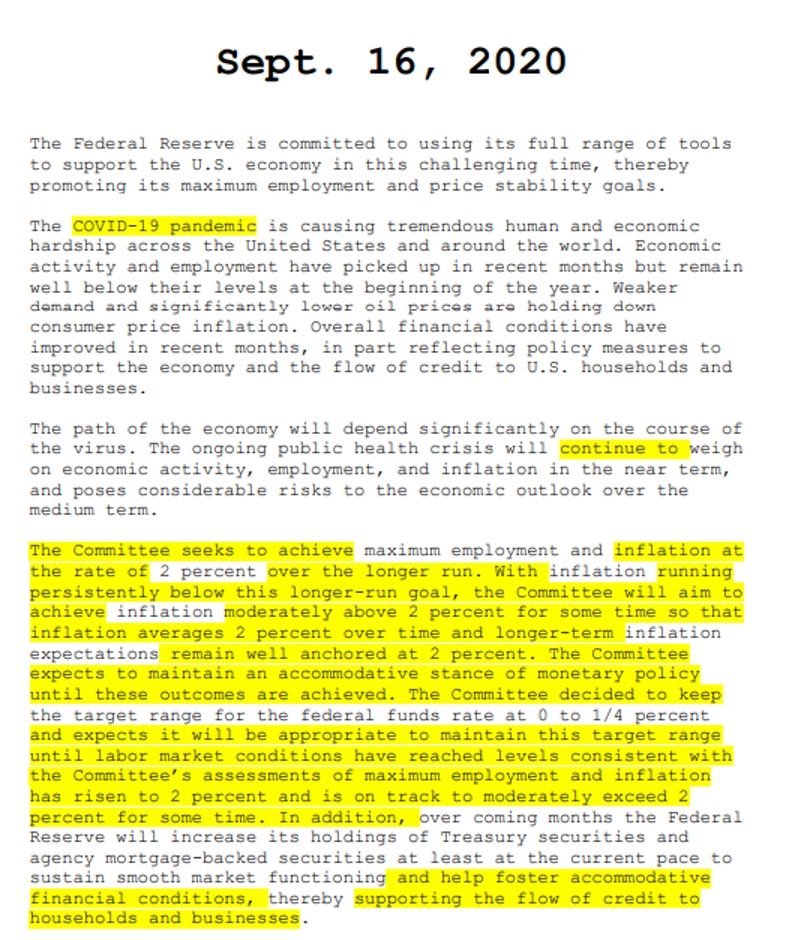

As mentioned in prior notes the market is watching moves in US (and relative) real yield so closely. This to me why the USD is rallying and the combination of higher real yields and a strong USD is not one that the equity bulls will want to see. It represents a liquidity drain for global markets and should financial conditions deteriorate then the Fed will ramp up QE - just read the September statement (the yellow highlight denotes change from July statement) - the Fed said they will start to use QE to foster accommodative financial conditions. This is new and will be a large focus on this weekend’s webinar which I encourage you to sign up for.

(Source: Bloomberg)

If the world wants a weaker USD, they need fiscal as US economics have plateaued and the economy needs more if Q4 GDP is going to hold up. However, fiscal is slipping away and many of the programs are not creating the sort of fiscal boost that is needed. The Fed can’t boost inflation expectations sufficiently at this point, but again that is what is needed, and as real yields are rising now so too is the USD. In this chart, I’ve overlapped US 10yr real Treasuries vs the EURUSD (and inverted/flipped). But the fact is unless we see fiscal soon, which looks less likely given the movement from Trump to put in a new conservative Justice this side of the election, not to mention renewed COVID-fears in the UK and EU, the upside catalyst in inflation expectations are missing.

So, if real yields move higher then so will the USD and the technicals are telling us we are at a key juncture.

(Source: Bloomberg)

做好交易准备了吗?

只需少量入金便可随时开始交易。我们简单的申请流程仅需几分钟便可完成申请。

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。