差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。80% 的散户投资者在于该提供商进行差价合约交易时账户亏损。 您应该考虑自己是否了解差价合约的原理,以及是否有承受资金损失的高风险的能力。

The Daily Fix: Trump walks away from Fiscal, but did he really have a choice?

Did the market get stimulus wrong? Perhaps, but they’ve been guided to expectations of bipartisan agreement through recent upbeat dialogue between various leaders. It’s not even just about FOMO these days, but if an agreement was to be struck, you just can’t be left behind – FOMU – Fear of Meaningfully Underperforming.

I've maintained a sceptical view on fiscal given I don’t think the DEMs ever really wanted a deal – why would they? The wind is to their backs, they’re up double digits in the polls and delivering a deal would have given Trump ammunition to take into the election. Well, at least it would've back in August and September, with personal income dramatically boosted and disposable capital ramping up, which would have meant the difference between US Q4 GDP being 10% or 2%, following a likely 30% GDP print in Q3. The DEMs have also recently been helped by news of Trump's taxes, an unfavourable performance in the first debate and the appointment of Amy Coney Barrett. The likes of Nancy Pelosi knew their $2.4t proposal would have unlikely passed through the Senate anyhow.

Trump may have accepted the DEMs proposal, but again knew it would likely have failed in the Senate. He has promised more stimulus post-election, but the DEMs are not going to lose the House, so passing a Trump stimulus in the future (if he was to win) still faces headwinds. Although, these headwinds will be less of an issue after the election. More fiscal is needed, which is a concern given how much has already been rolled out.

Trump’s tweet clearly resonated through markets sending the S&P 500 down 2.2% from the highs of the day, to close -1.4%. The US2000 has certainly outperformed with the small-cap index -0.3%, but it’s enough for me to close my long here for a small loss. The NAS100 closed -1.9% and we’ve seen NASDAQ futures trading 20bp lower on the re-open. Tech remains one to watch given headlines rolling out about the House DEMs plan to break up giant internet platforms from other business lines, limiting the monopolistic qualities of US tech.

Given the DEMs stance on tech, which I am not sure surprises too greatly, it makes me think that if we do see a ‘Blue Wave’ that long US2000 and short NAS100 will be an incredible medium-term trade. If the DEM’s promise huge fiscal spending which will benefit the Russell (the earnings are far more US-centric), while going after big tech, I find it hard to see how this will not be a solid macro thematic trade.

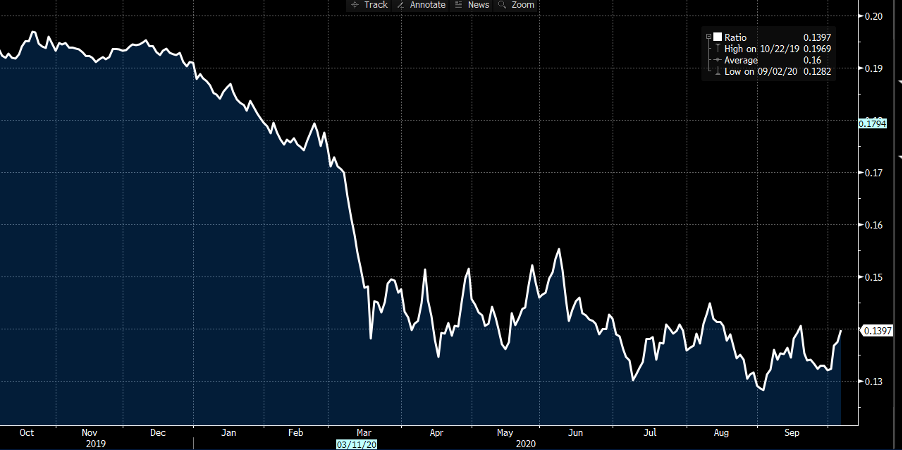

The Trump tweet caused a rush to safe havens with US Treasuries bid, with 10s dropping 5bp to 72bp before finding a base, the VIX pushing into 29.5%, and the USD, CHF and JPY all finding buyers, with selling resonating in AUD, MXN and NOK most prominently. AUDUSD was falling anyhow, with one prominent local commentator calling for the RBA to act in November and we see the rates market at 7bp for November and the Aussie 3-yr Treasury now trading at 13.4bp – a cut, it seems is coming, while the RBA will lower the yields cap. More QE for good measures?

Market pricing aside, the RBA made it clear that this is a confidence issue faced in the real economy, not a cost of credit problem. If we explore the last line in the statement – “The Board continues to consider how additional monetary easing could support jobs as the economy opens up further”, it's hard to see how cutting either the cash rate or reducing yield caps aids that. The budget is key here and seems market-friendly enough, and the RBA will welcome the measures, but it's going to be a slow-moving ship and one that may take time to filter into the economy.

We look ahead to see how Asia deals with the above news flow. As we look to Europe the focus falls on German industrial production, September FOMC minutes, and then to the Vice-president debate which promises to be a far more statesman like affair.

Related articles

做好交易准备了吗?

只需少量入金便可随时开始交易。我们简单的申请流程仅需几分钟便可完成申请。

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。