差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。80% 的散户投资者在于该提供商进行差价合约交易时账户亏损。 您应该考虑自己是否了解差价合约的原理,以及是否有承受资金损失的高风险的能力。

The aim is to magnify your position with daily 3x leverage. The ETF is not aimed at long-term investors, but short-term daily returns.

What does the TECL invest in

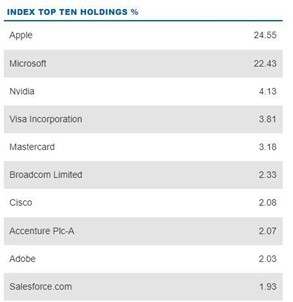

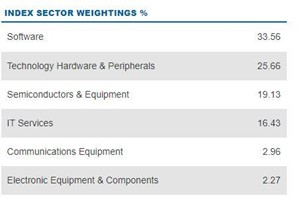

The Technology Select Sector Index (IXTTR) is the target index. It is provided by S&P Dow Jones Indices and covers various companies from the technology sector. It is heavily weighted in Apple and Microsoft. It should be noted that you cannot directly trade the index.

Figure 2 direxion sector weighting

Net expense ratio

This includes management fees. This is the annual fee payable to the issuer. As of the 17th of October 2022, the fees stood at 0.94%

*What is leverage?

Leverage is the ability to borrow funds to increase your exposure in the market. Leverage can exponentially increase your profits as well as your losses so it's crucial that traders take care when using leverage. The larger your position size, the larger your point value will be and therefore, the greater the impact on your profit/loss (P/L).

Trading Hours

The TECL (or TECS) do not offer 24 hr trading. The open and close is in line with the US stock market.

Figure 3 Trading View TECL trading hours

A look from a technical perspective

As the TECL is a technology long (buy) fund, it makes sense that it will underperform when the US technology sector is under pressure. It also makes sense that, because the fund uses leverage, the losses are compounded compared to the underlying sector. In the chart below we can see that the Nasdaq100 has fallen -21.57% since the 15th of August 2022. The TECL (long technology fund) has devalued -56.94% as of October 16th 2022.

Figure 4 Trading View TECL performance

It also makes sense that the TECS fund (short only fund) has outperformed in this bear market with a gain of 99.48% over the same period.

Figure 5 Trading View TECS performance

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。